Will Bitcoin Ordinals ignite the next wave of Cryptocurrency and NFTs in 2023?

In the ever-evolving world of cryptocurrencies, Bitcoin has remained a dominant force, captivating both enthusiasts and skeptics alike. As we embark on the year 2023, the future of crypto is teeming with exciting possibilities, and Bitcoin’s unique ordinals hold the key to shaping this dynamic landscape.

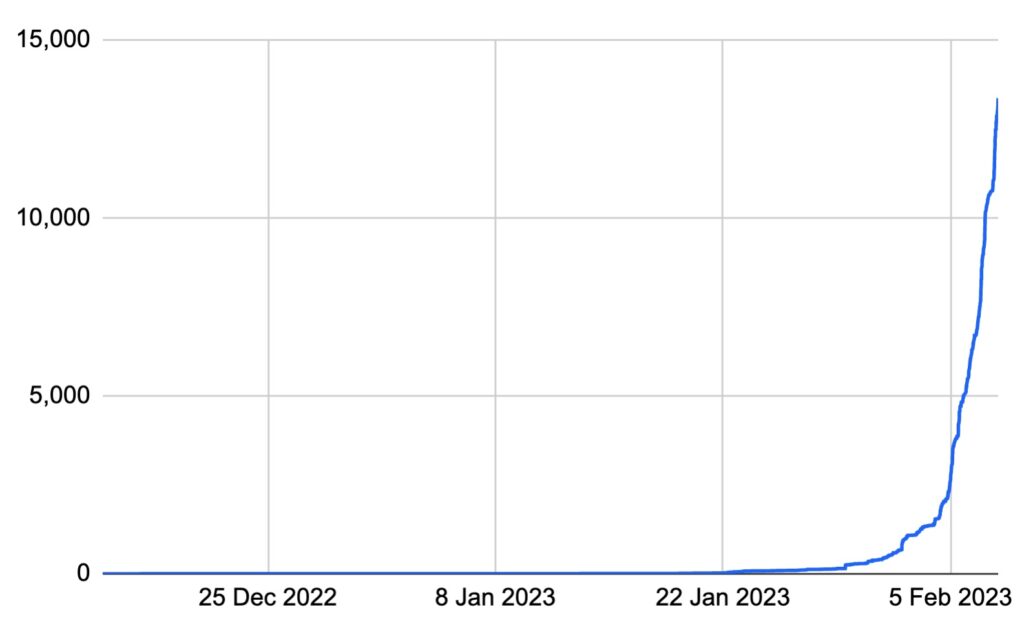

In January of this year, Casey Rodarmor introduced the ordinals protocol, a significant milestone for the Bitcoin community. This groundbreaking development empowers individuals to create Bitcoin NFTs (non-fungible tokens) directly on the Bitcoin blockchain. The advent of Bitcoin ordinals has gained rapid momentum, with an impressive 13,000 ordinal NFTs already present on the blockchain by February 8th.

The growing cumulative count of ordinal inscriptions. Source: Bitmex

From enabling fractional ownership to revolutionizing cross-border transactions, Bitcoin ordinals have the potential to transform the way we perceive and interact with digital currencies.

Read this article as we delve into the extraordinary potential of Bitcoin ordinals and explore how they can shape the future of crypto.

Introducing Bitcoin Ordinals

Bitcoin ordinals refer to the division of a whole Bitcoin into smaller units, extending beyond the conventional decimal system. While Bitcoin is traditionally divisible up to eight decimal places, the emergence of ordinals introduces new levels of granularity. This innovation opens the door to fractional ownership, allowing individuals to possess smaller portions of a Bitcoin, making it more accessible to a broader range of investors.

Why should you care about Bitcoin Ordinals?

In the world of cryptocurrencies, Bitcoin ordinals are revolutionizing the way we perceive and interact with digital assets. If you’re wondering why you should care about Bitcoin ordinals, the answer lies in the immense potential they hold for fractional ownership, financial inclusion, and decentralized finance.

By enabling the division of a whole Bitcoin into smaller units, ordinals make it more accessible for investors of all sizes, allowing you to participate in the crypto market without the need to purchase a whole Bitcoin.

This fractional ownership opens doors to diverse investment opportunities and empowers individuals to take control of their financial future. This advancement has unlocked fresh possibilities for Bitcoin, paving the way for the emergence of Bitcoin NFTs.

Pros of Bitcoin Ordinals

1. Fractional Ownership:

Bitcoin ordinals allow for fractional ownership, enabling individuals with limited capital to invest in Bitcoin and participate in the cryptocurrency market.

According to a report by Glassnode, as of May 2021, over 13% of Bitcoin addresses hold less than 0.001 BTC, which is equivalent to approximately $50 at the time of the report. This indicates that fractional ownership is prevalent in the Bitcoin market, allowing individuals with limited capital to invest in Bitcoin and participate in the cryptocurrency market.

2. Accessibility:

According to a survey conducted by the Global Findex Database in 2017, approximately 1.7 billion adults worldwide remain unbanked, lacking access to basic financial services. Bitcoin ordinals, by enabling smaller investments, can help bridge this gap and provide financial inclusion to a significant portion of the population.

By dividing a whole Bitcoin into smaller units, ordinals make Bitcoin more accessible to a broader range of investors, promoting financial inclusion and democratizing investment opportunities.

3. Versatility:

Bitcoin ordinals can be used for various purposes, including microtransactions, remittances, decentralized finance (DeFi), and creating new types of Bitcoin-based assets.

As of September 2021, the total value locked (TVL) in DeFi protocols exceeded $80 billion, showcasing the versatility and utilization of cryptocurrencies like Bitcoin in decentralized finance applications.

4. Security:

Ordinals benefit from the robust security of the Bitcoin blockchain, providing a secure and immutable record of ownership and transactions.

As of September 2021, the Bitcoin network’s hash rate, a measure of computing power securing the network, exceeded 140 exahashes per second. This immense computational power makes the network highly resistant to malicious attacks and reinforces the security of Bitcoin ordinals.

Cons of Bitcoin Ordinals:

1. Market Volatility:

As with any investment linked to Bitcoin, the value of Bitcoin ordinals can be subject to significant price fluctuations. If the price of Bitcoin decreases, the value of NFTs based on Bitcoin ordinals may also decrease, potentially resulting in financial losses for investors.

Recent statistics show Bitcoin has exhibited substantial price volatility. For instance, between April 2023 and May 2023, the price of Bitcoin ranged from around $27,591.4 to over $27,313.6. Such fluctuations can impact the value of Bitcoin ordinals and NFTs based on them.

2. Scalability Challenges:

As the number of Bitcoin ordinals increases, scalability issues may arise, potentially impacting transaction processing times and fees on the Bitcoin network.

According to a study conducted by Tata Communications, it was revealed that 44% of the surveyed organizations are embracing blockchain technology. However, the study also highlights the challenges that arise when implementing new technologies. At an architectural level, scalability has emerged as a significant hurdle hindering the widespread adoption and practical implementation of blockchain.

Ordinals Vs NFTs

While both Bitcoin ordinals and Non-Fungible Tokens (NFTs) have gained significant attention in the crypto space, they serve different purposes.

Traditional NFTs are typically constructed using smart contracts on various blockchain platforms like Ethereum, Solana, Cardano, and others. Additionally, the assets associated with NFTs can be hosted on different platforms, whereas Ordinals are directly inscribed onto individual SATs (Satoshi units), which are then added to the Bitcoin blockchain.

Over 12,000 NFT sales occur every day.

It has also been disclosed that there are over 10,000 active wallets engaging with NFTs every day, as well as approximately 6,000 unique purchasers. (demandsage)

In contrast to traditional NFTs, Ordinals exclusively reside on the Bitcoin blockchain, eliminating the need for a sidechain in or separate token. This distinction grants Ordinal inscriptions the benefits of simplicity, immutability, security, and durability inherent to the Bitcoin blockchain. Moreover, the ordinal scheme’s unique approach allows for the distinctive identity of each SAT, thereby facilitating the emergence of a novel class of Bitcoin-based assets.

What makes Bitcoin NFTs Ordinals Different?

The NFT Market will reach $80 Billion in worth by 2025. (demandsage)

The primary distinction between Bitcoin ordinals and more conventional types of NFTs lies in their inherent flexibility. Since the Bitcoin protocol does not formally acknowledge ordinal theory, an ordinal can possess either fungible or non-fungible characteristics. This classification entirely depends on the preferences of the ordinal holder and their intention to preserve the individual satoshi.

For instance, if a Bitcoin user disregards or shows no interest in an ordinal or the associated data, it can be utilized just like any other Bitcoin. In this context, ordinals are fungible, enabling them to be employed for network fees or sent as payment, while retaining the attached arbitrary data. This stands in contrast to Ethereum NFTs. An Ethereum NFT bears no resemblance to an Ethereum coin, and it is impossible to confuse a fungible token with an NFT due to the distinct treatment of each token type within the Ethereum Network.

Bitcoin Ordinal Use Cases

1. Store digital art, collectibles, and other assets as NFTs on the Bitcoin blockchain:

NFTs provide a means to tokenize and authenticate digital art, enabling artists to establish ownership and provenance. By minting their artwork as NFTs on the Bitcoin blockchain, artists can create a verifiable and transparent record of ownership, facilitating the buying, selling, and trading of digital artworks.

Additionally, NFTs can represent collectibles such as virtual trading cards, virtual real estate, and other digital assets, offering a new dimension to the world of digital ownership and commerce.

2. Decentralized applications (dApps):

Developers can leverage the Bitcoin blockchain to build decentralized applications that store data and execute smart contracts. By utilizing NFTs as a means of representing and managing unique assets or user identities, dApps can create secure and transparent platforms for various purposes such as gaming, decentralized finance (DeFi), supply chain management, and more.

NFTs provide a framework for developers to create innovative and user-centric decentralized applications that harness the benefits of the Bitcoin blockchain.

3. Supply chain management:

Ordinals can play a crucial role in supply chain management by providing a transparent and immutable record of the provenance of goods and services. Each step of the supply chain process can be documented and stored as an ordinal on the Bitcoin blockchain, ensuring traceability and reducing the risks of counterfeit products.

This enhanced transparency and accountability can greatly benefit industries such as luxury goods, pharmaceuticals, and food supply chains, promoting consumer trust and product authenticity.

4. Voting:

The unique properties of ordinals on the Bitcoin blockchain can be leveraged to create a secure and tamper-proof voting system. By assigning each voter a unique ordinal and recording their votes on the blockchain, it becomes virtually impossible to manipulate or alter the voting results. The transparency and immutability of the Bitcoin blockchain ensure the integrity of the voting process, potentially revolutionizing democratic systems by enhancing trust, reducing fraud, and promoting fair elections.

5. Land registry:

The Bitcoin blockchain can serve as a secure and decentralized platform for storing land ownership records. By representing land titles as NFTs on the blockchain, the process of verifying and transferring property ownership can become more efficient, transparent, and resistant to fraudulent activities. This application has the potential to streamline land registration systems, particularly in regions where traditional land registries face challenges related to corruption or inefficiency.

Services we offer for Bitcoin Ordinals

1. Development of Ordinals Software:

Renesis specializes in developing advanced software solutions tailored to the needs of businesses and individuals looking to create, mint, and manage Bitcoin ordinals. Their experienced team of blockchain developers can design and build robust, user-friendly platforms that empower users to engage with Bitcoin ordinals efficiently and securely.

2. Consulting Services:

Renesis offers expert consulting services to guide clients in understanding and leveraging the potential of Bitcoin ordinals. Their team of consultants possesses in-depth knowledge of the intricacies surrounding Bitcoin ordinals and can provide strategic insights, technical expertise, and regulatory guidance to help businesses and individuals navigate the realm of ordinals effectively.

3. NFT Marketplaces:

Renesis has the capabilities to create and operate NFT marketplaces dedicated to ordinal NFTs. These marketplaces are designed to facilitate seamless transactions, allowing users to buy, sell, and trade their ordinal NFTs with ease. Renesis ensures that its marketplaces offer a user-friendly interface, advanced search and discovery functionalities, and robust security measures to protect users’ assets.

4. NFT Wallets:

Renesis provides secure and reliable NFT wallet solutions that enable users to store and manage their ordinal NFTs conveniently. Their wallet offerings include web wallets, mobile wallets, and hardware wallets, providing users with options that suit their preferences and requirements. Renesis emphasizes the importance of security and implements robust measures to safeguard users’ ordinal NFTs.

5. NFT Security:

With a focus on protecting digital assets, Renesis offers comprehensive security services for ordinal NFTs. Their solutions encompass sophisticated security protocols, multi-factor authentication, encryption mechanisms, and proactive monitoring to prevent theft, fraud, and unauthorized access. In case of any mishaps, Renesis provides efficient recovery services to help clients retrieve lost or stolen ordinal NFTs.

As we venture into the year 2023 and beyond, the potential of Bitcoin ordinals to shape the future of crypto cannot be overlooked. From fractional ownership and financial inclusion to disrupting cross-border transactions and enhancing privacy and security, the possibilities are immense.

Bitcoin ordinals have the power to revolutionize the way we perceive and interact with cryptocurrencies, opening up new opportunities for individuals across the globe.

So, embrace the future, explore the potential of Bitcoin ordinals, and be part of the transformative journey towards a decentralized, inclusive, and secure financial landscape.